One Platform. Any Asset. Any Chain

Enterprise-grade tokenization & orchestration for the next generation of digital economies

Token Layer Ecosystem

Token Taxonomy

- Token Taxonomy Framework (TTF) W3C Verifiable Credentials

Testing, Audit & Certification

- Ganache (Ethereum testnet) MythX | certiK SecuredApps

Regulatory & Legal Frameworks

- MiCA (EU) MAS Guidelines (Singapore) GIFT IFSC Sandbox

Compliance, KYC & Identity

- Civic / Polygon ID/ Fractal

- Chainanalysis / TRM Labs / Elliptic

Custody & Wallet

- Fireblocks/ Copper

- Metmask Institutional / Ledger Enterpriseetting has been the industry

Tokenization Platforms

- Polymath / Securitize / Tokeny

- Codefi (ConsenSys)

- R3 Corda TOken SDK/ IBM Fabric SDK

- Boson / Ocean Protocol

Token Standards

- ERC-20 / ERC-721 / ERC-1155

- ERC-1400 / ERC-3643

- ISO 24165 (DTI)

- SPL Tokens (Solana), FA1.2/ FA2 (Tezos)

Cross-Chain Interoperability

- Chainlink CCIP

- Cosmos SDK / Polkadot / Hyperledger Cactus

Digital Asset Tokenization

Use Cases

Tokenized Real-World Assets

Browse, invest, and manage your portfolio in one intuitive interface.

Digital Bond & Debt Instruments

For asset originators to tokenize, upload documents, and monitor investments.

Product Passport (Digital Twin Tokens)

Create unique digital identities for products in circular economy & traceability.

Carbon Credits & ESG Tokens

Issue, verify, and trade ESG tokens like carbon offsets and impact bonds.

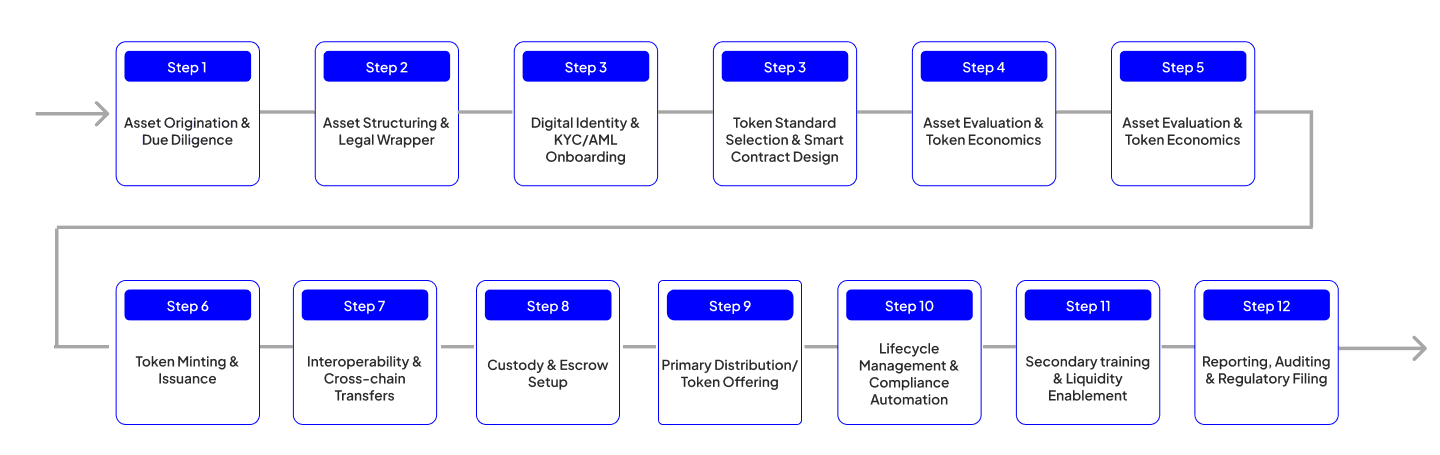

Our Approach

Services

Universal Asset Tokenization Engine

Chain-Agnostic Interoperability Layer

Fully Parameterized Smart Contract Factory

Integrated Compliance & Governance Module

Enterprise & Developer Friendly APIs

Future-Proof Token Marketplace Gateway

Blockchain Ecosystem

Technology Stack